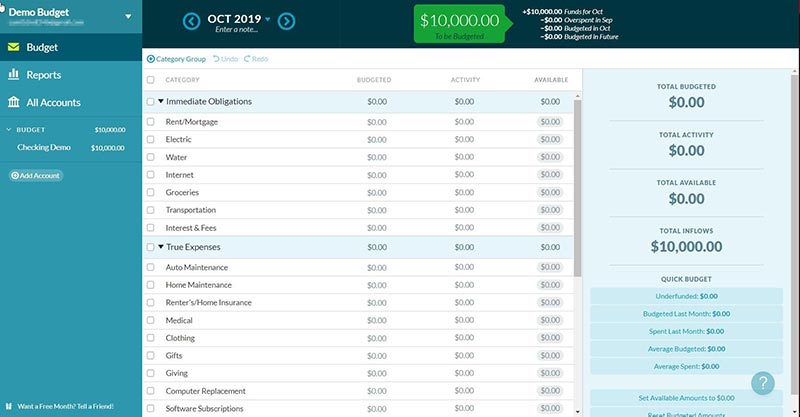

Version 4 was maintained through 2016, and the company ended support for Version 4 in October 2019. Storing the budget file in Dropbox allowed synchronization between the desktop and mobile applications. Version 4 was a desktop-based application available for Windows and Mac OS, with apps for iPhone and Android devices. The previous version, YNAB4, was released in June 2012. The software is updated multiple times a month to add new features, tweak existing ones, and improve security and back-end functioning. The latest version, dubbed "The New YNAB" or "nYNAB", was launched Decem as a web-based application, with apps for iPhone, iPad, and Android devices. Students who verify their status by providing a school document receive their first year free. After the 34-day free trial ends, users pay $98.99 per year, or $14.99 per month. The platform also has several open-source add-ons that can expand on YNAB's features. The software also displays financial reports to keep users informed about their finances at a glance. Users can either import transactions automatically from their financial institutions or input them manually. Over time, users are encouraged to "age their money", accumulating savings and watching their money grow.

When overspending occurs, the app encourages users to move money between categories to "roll with the punches" if more funds than allocated are spent in a category.

It encourages users to be flexible in their spending. The app encourages users to consider recurring expenses every month to prevent spending "surprises" and break the paycheck-to-paycheck cycle. Each dollar is allocated to a specific purpose, such as annual car insurance payment, long-term housing repair fund, college savings, etc. The general theory of YNAB is to "give every dollar a job". YNAB is a personal budgeting software platform that can be used across desktop computers, the iPhone and Android operating systems, iPads, Apple Watches, and the Amazon Echo system.

0 kommentar(er)

0 kommentar(er)